In as much as investments are the easiest way to financial independence, one has to look at every investment thoroughly before diving in. Is the Phoenix Capital Group one of the good investments or just another scam? Let’s find out…

What is the Phoenix Capital Group?

Phoenix Capital Group Holdings, LLC is a company that was established in 2019 and is located in Denver, Colorado. They have expertise in acquiring oil and gas mineral rights and investments.

With a strong presence in multiple locations throughout the United States, this company has been passed down through generations. It is dedicated to generating value for both landowners and investors, by leveraging its deep energy sector knowledge, and cutting-edge technology. Also comprehensive financial analysis.

It can effectively cater to the needs of its clients. Phoenix assists American landowners in optimizing their mineral assets by providing direct investment opportunities that were once exclusive to affluent individuals.

Phoenix eliminates intermediaries to offer investors the opportunity to earn high-yield returns. With an annual yield target of up to 13%, Phoenix aims to make profitable energy investments more easily attainable.

What does the Phoenix Capital Group Do?

Phoenix Capital Group Holdings, LLC is an investment and wealth management firm that focuses on real estate, energy, and mineral companies. They serve clients throughout the United States, providing expertise in managing mineral interests such as leasing, oil and gas production, and royalties.

Phoenix Capital Group introduces new investment opportunities in the lucrative oil and gas sector, which was previously reserved for high-net-worth individuals. They have created investment products that promise high returns and allow for direct investment without the use of intermediaries. This novel approach combines advanced analytics and industry knowledge to provide passive income opportunities with high annual yields.

Related: FintechZoom IBM Stock: A Detailed Investment Guide.

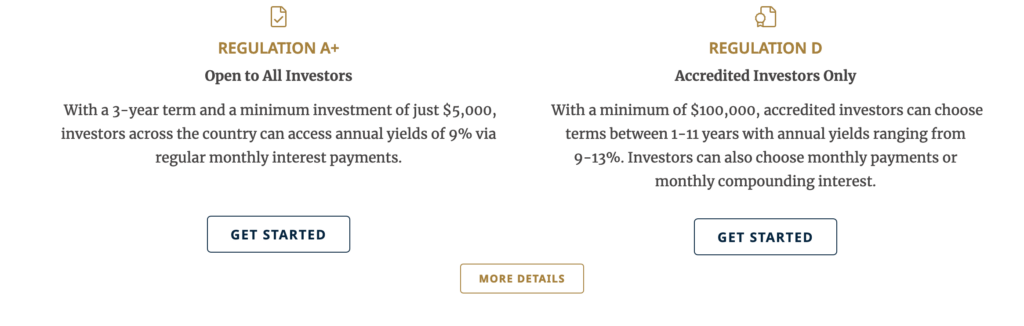

For investors, Phoenix provides two main plans:

Regulation A+: This plan is open to all and requires a minimum investment of $5,000 for a three-year term, with a 9% annual yield paid out monthly.

Regulation D: Available only to accredited investors, this option requires a $100,000 minimum, has terms ranging from 1 to 11 years, and yields between 9 and 13%. Monthly payments are an option, as is compounding interest.

By focusing on mineral rights and interests, they provide a platform for investing in assets such as oil and gas, with plans tailored to both accredited and non-accredited investors and the goal of achieving significant returns on investment.

Is the Phoenix Capital Group Legit?

Phoenix Capital Group Holdings, LLC (PCGHLLC) is a reputable investment firm that focuses on real estate, energy, and minerals. Firsthand experiences and reviews demonstrate that this company stands out for its professionalism and dependability. Investors have reported consistent on-time monthly payments and interest earnings that match the promised rates. This solid performance and impressive revenue targets demonstrate PCGHLLC’s strong position in the investment sector.

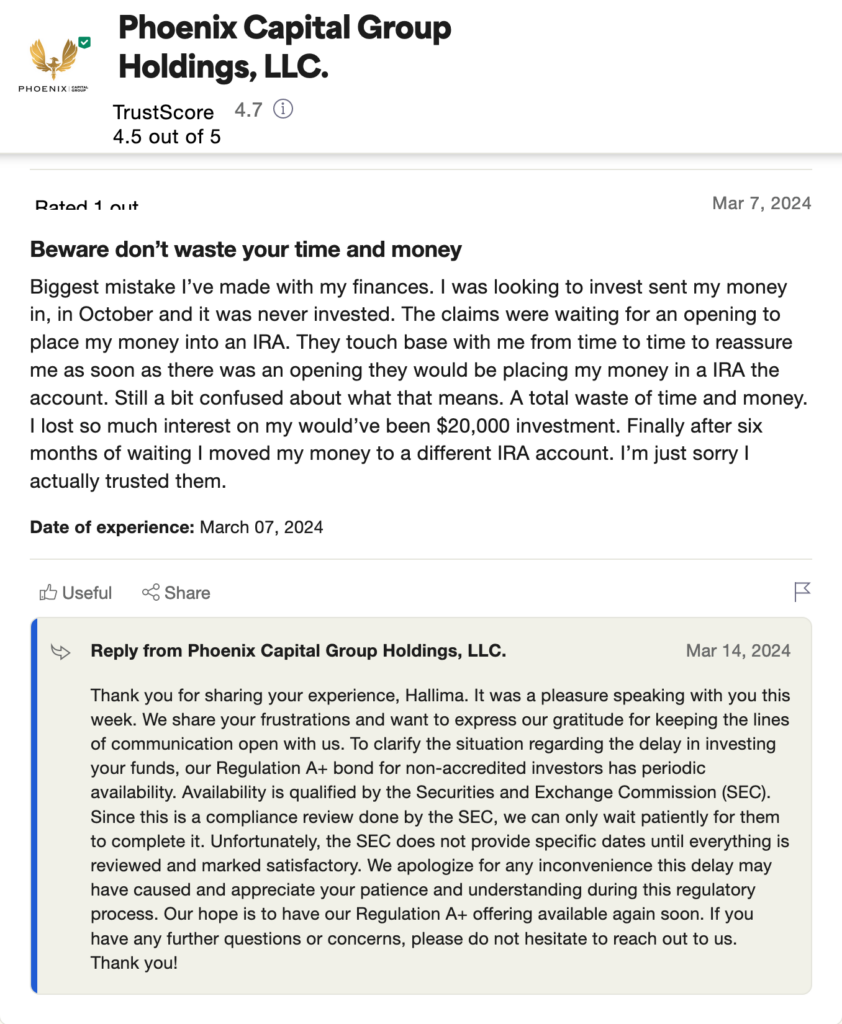

The company has received positive feedback, earning a 4.7-star rating from 253 reviews on Trust Pilot. A significant 89% of these are five-star ratings, indicating investor satisfaction. Only a small percentage of reviews are less than 3 stars, highlighting the firm’s overall positive impact on its clients.

Such feedback supports PCGHLLC’s legitimacy as an investment option. Investors are comfortable entrusting their funds, particularly for retirement, to PCGHLLC. The company’s commitment to doing what it says, exactly when it says it will, has helped to build trust and credibility.

To note, there are also some bad reviews, which are obviously not unusual. However, going by having over 200 positive review from different people, they are legit as at March 2024. The good part is, they reply to all their good and bad reviews like every legit business should. See below

Related: What to look for in finance internships? 2024 Updated.

How you can Invest at the Phoenix Capital Group

Investing with Phoenix Capital Group provides a structured and rewarding approach to building wealth in the oil and gas industry. Here’s a simple guide to getting started:

Select High-Yield Assets: Phoenix uses cutting-edge technology to identify high-performing energy assets for investment. This strategic decision is the foundation for achieving high returns.

Pool Capital: Investor funds are pooled to acquire new, income-generating mineral assets throughout the United States. This collective approach increases purchasing power and revenue potential.

Earn Monthly Revenues: Oil and gas operators provide investors with consistent monthly revenue, which is paid out for the life of the mineral royalty asset.

Receive Interest Payments: Phoenix has committed to paying up to 13% annual yield in monthly interest over the bond’s term. Some plans also include compounding interest, which boosts investment growth.

See also: How to Earn Money Online without Investment in 2024

Investment options

Regulation A+: Open to all investors, providing a 9% annual yield over three years with a $5,000 minimum investment.

Regulation D: Designed for accredited investors, with annual yields of 9% to 13% over terms ranging from 1 to 11 years and a $100,000 minimum investment.

Investing in Phoenix Capital Group not only provides attractive returns but also teaches you how to maximize the value of mineral rights. Phoenix’s focus is on financial security and investment longevity, to create generational wealth for partners. The process is designed to be quick, efficient, and transparent, giving investors peace of mind at every stage.

Conclusion

In conclusion, Phoenix Capital Group is a legitimate and trustworthy investment firm. Analyzing customer reviews reveals that investors are highly satisfied and confident. The company’s consistent performance in meeting its commitments has made it a popular choice for those looking to diversify and strengthen their investment portfolios.