FintechZoom, a force in the financial sector, has been making waves across markets and affecting tech giants like IBM. Here, we will explore how FintechZoom’s innovative solutions impact IBM stock prices. Let’s get started!

What is FintechZoom?

FintechZoom is an innovative platform that provides investors with a comprehensive view of the financial markets. It offers real-time stock analysis, news updates, investment recommendations, and more, all in one place. The platform’s user-friendly interface and data-driven approach have transformed the way investors access and understand market information.

FintechZoom aggregates data from multiple sources, using advanced analytics to give users a complete picture of the market landscape. This allows investors to make informed decisions, whether experienced or new to trading.

Historical Performance of IBM Stock

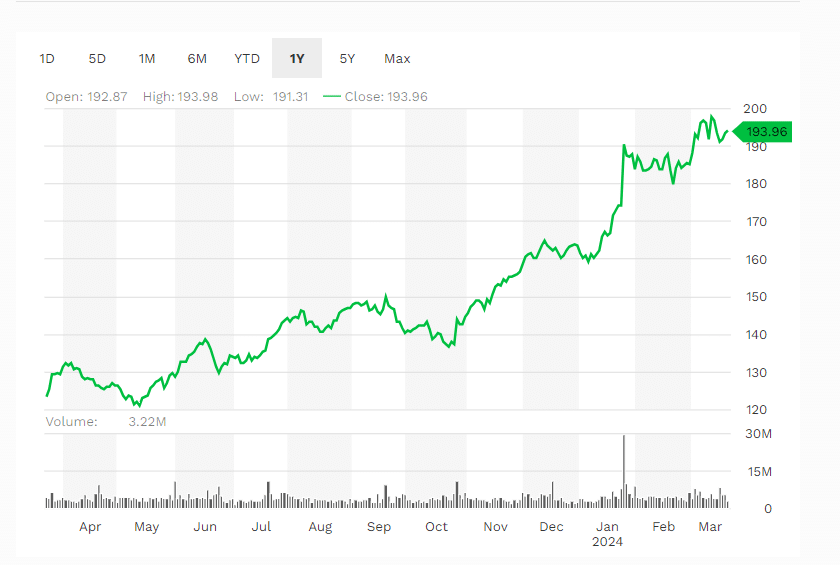

Let’s take a look at the historical performance of IBM stock and how it has changed over the years. IBM has been a key player in the tech industry, adapting to market trends and innovations.

In 1980, IBM was a major player on Wall Street, and its stock price reflected its dominance in computing. However, as technology rapidly evolved, IBM faced challenges and its stock value fluctuated.

During the early 2000s, IBM made strategic shifts towards cloud computing and artificial intelligence, which boosted investor confidence. Despite competition from newer tech giants, IBM managed to maintain stability in its stock performance.

Over time, IBM’s stock has experienced ups and downs, influenced by economic cycles and technological advancements. Investors closely monitor these fluctuations to make informed decisions about their portfolios.

FintechZoom’s Influence on IBM Stock

FintechZoom plays a crucial role in shaping investor strategies for IBM stock. By analyzing user behavior, sentiment analysis, and trading patterns on the platform, we can understand how FintechZoom influences market sentiment and investor decisions regarding IBM stock.

FintechZoom’s data-driven approach allows investors to access real-time information, news updates, and analysis related to IBM. Whether it’s earnings reports, product announcements, or strategic partnerships, FintechZoom offers timely insights into events that may affect IBM’s stock price.

Furthermore, FintechZoom’s social features, like discussion forums, user-generated content, and expert commentary, encourage community engagement and knowledge sharing among investors. By leveraging FintechZoom’s comprehensive resources and community insights, investors can gain alternative perspectives and make more informed decisions regarding IBM stock.

Key Factors Driving IBM Stock in the FintechZoom Era

Assessing IBM’s stock requires four key factors. These include technological innovations, industry trends, macroeconomic indicators, and corporate initiatives. Understanding these drivers is crucial for making informed investment decisions.

1. Technology

IBM’s ability to innovate and adapt to emerging technologies, such as blockchain technology and artificial intelligence, impacts its stock performance. Investors evaluate IBM’s strategic positioning and competitive advantage in capturing market opportunities.

2. Industry Trends

IBM operates in a rapidly evolving industry with digital transformation, cybersecurity threats, and changing customer preferences. Monitoring industry trends and competitive dynamics helps investors assess IBM’s ability to anticipate market shifts and capitalize on emerging opportunities.

3. Macroeconomic Factors

IBM’s stock performance is also sensitive to macroeconomic factors, such as economic growth, interest rates, inflation, and currency fluctuations. Global economic conditions impact IBM’s revenue growth, profitability, and cash flow generation, influencing investor sentiment and stock valuation.

4. Corporate Initiatives

IBM’s strategic initiatives, such as acquisitions, divestitures, partnerships, and restructuring efforts, shape its growth trajectory and financial performance. Investors scrutinize management’s execution capabilities, capital allocation decisions, and long-term strategic vision to assess IBM’s value creation potential.

Risks and Challenges

While FintechZoom offers you benefits, it also poses a few risks for your IBM stock investments.

1. Data Accuracy

FintechZoom gathers information from financial news sites, official filings, and social media. However, the accuracy and reliability of this information can sometimes be questionable. Misinformation, rumors, and data mistakes might skew your perception of the market, leading to poor investment decisions on your part.

2. Market Fluctuations

The platform’s instant stock analyses and news updates can cause market instability, especially in uncertain or speculative times. Quick shifts in IBM stock value may trigger trading algorithms and lead to herd behavior among investors like you, further amplifying price variations and trading volumes.

3. Liquidity Risks

In difficult times, you may find it challenging to execute trades at your preferred prices, especially for large orders. Operational challenges, system failures, or connectivity issues with FintechZoom’s trading system could limit your access to liquidity and your ability to manage risks.

Future Predictions for IBM Stock Based on FintechZoom

To make the most of your investment in IBM stocks using FintechZoom, consider these strategies to boost your returns:

1. Use Analytics Tools

Utilize FintechZoom’s analytics tools, like technical analysis, to spot investment chances and manage risks. Tools that show data visually, such as charts and heatmaps, can help you see trends and make decisions.

2. Keep Up with Trends

Keep an eye on the latest market movements, industry news, and economic signs to stay ahead. Keeping up with updates on earnings and financial news will give you insights into where the market might be heading.

3. Think Long-Term

Look at investing in IBM as a long journey. This approach helps you get through the ups and downs in the market and benefit from growing your investment over time. Focus on IBM’s growth, profits, and how it makes money to guide your investment choices.

4. Manage Risks

Use strategies like setting stop-loss orders to protect your investment from big losses. Manage how much you invest in different areas to keep a balanced portfolio and consider using hedges to protect against unexpected market changes.

Conclusion: Should Investors Consider FintechZoom When Investing in IBM?

The relationship between FintechZoom and IBM stock highlights how financial tech has changed investment strategies. Through FintechZoom, you gain access to real-time data, advanced analytics, and algorithmic trading capabilities, empowering you to make better financial decisions. However, investing in IBM stock through FintechZoom requires careful consideration, as you need to understand market dynamics and risk factors.